Investment in real estate is an almost sure way of making money!!

Property is an asset which almost always appreciates. It is now an important part of an investor’s portfolio. As a matter of fact, buying property for investment and disposing it of later at a higher price has, no doubt, become very common among investor-class. Mainly because, such transactions usually bring good profit whereas the chance of incurring loss is only a little.

However, the tax liability on the profit from such transactions may act as a deterrent unless the investor is aware of the exact tax structure of such profit. If you are thorough with the rules of taxation of real estate transactions, you can indeed reduce your tax liability.

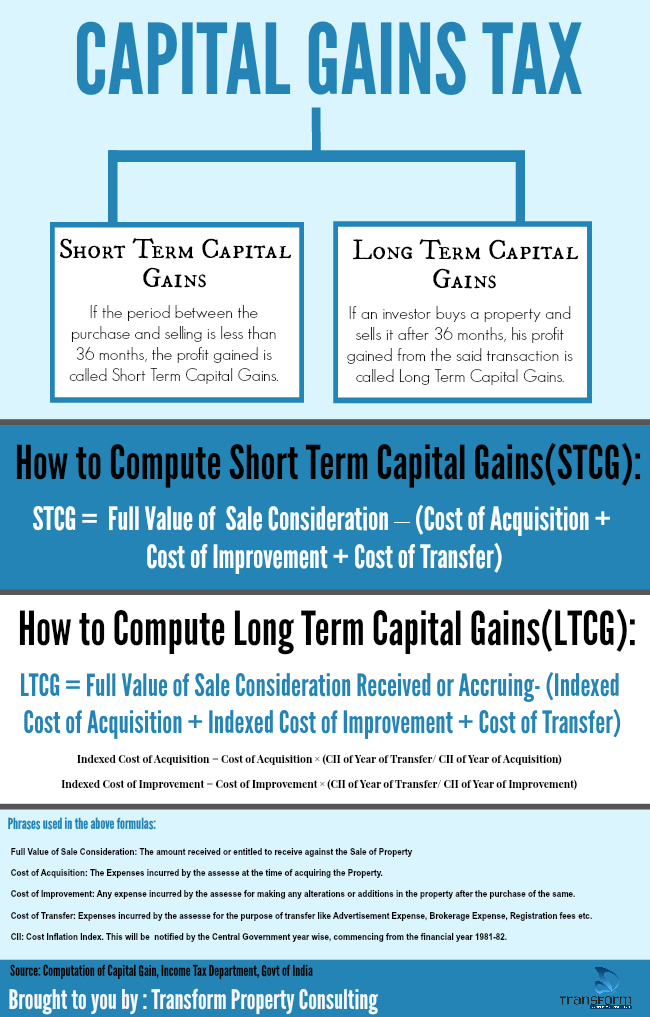

What is Capital Gains Tax? Which are the categories?

The profit arising from real estate transactions is called Capital Gains tax. Let us analyse the the details of the capital gains tax on real estate transactions.

Broadly speaking, there are two categories of Capital Gains Tax based on the period of holding:

- Short Term Capital Gains (STCG)

- Long Term Capital Gains (LTCG)

Short Term Capital Gains

At times, the investor is tempted to sell the property without waiting for a long period. If the period between the purchase and selling is less than 36 months, the profit gained is called Short Term Capital Gains. We can ascertain the short term capital gain by deducting the cost price from the selling price. Short term capital gain will straightaway be added to the investor’s income and taxed as per the income slab in which he falls.

For example, in the case of a person whose income is in the maximum tax bracket, viz; 30%, he has to pay short term capital gains tax at the rate of 30%. On the other hand, if he is in the 10% bracket, his short term capital gain will be taxed at the rate of 10%. Moreover, there is no separate concession /deduction available for STCG.

Short Term Capital Gains is computed as below:

STCG = Full value of sale consideration – (Cost of acquisition + cost of improvement + cost of transfer)

The STCG as arrived above is taken as income under the head ‘Capital Gains’ for the purposes of determining the total income.

Long Term Capital Gains

Now, let us examine the details of LTCG. If an investor buys a property and sells it after 36 months, his profit gained from the said transaction is called Long Term Capital Gains. Unlike in stock market operations, the LTCG also will be taxed in the case of real estate transactions.

However, some concessions are admissible in the treatment of tax for long term capital gains as per section 54 of the Income Tax Act 1961. Of course, only individuals and Hindu Undivided families are eligible to claim the said concessions. Such concessions may be summarised as follows:

1. Income tax on long term capital gains is calculated at a flat rate of 20%. Even in the case of a person who is already in the 30% tax bracket, the LTCG will be taxed only @20%. To make it more clear, the LTCG in real estate transactions will be taxed @20% regardless of the income of the investor.

2. For calculating the LTCG, the cost price can be indexed based on the Cost Inflation Index (CII) which is published by the Reserve Bank of India every year.

3. Apart from the aforesaid concessions, in the case of LTCG, there are some avenues for getting some exemptions provided the investor utilises the capital gain for acquiring a new house or invests it in some prescribed bonds for specified period, of course with some conditions.

So far, we have been discussing the details of Short Term Capital gain and Long Term Capital gain. In a nutshell, we can conclude that STCG attracts relatively higher tax liability. In other words, if at all you decide to sell your property it is better to do so after waiting for at least 36 months, if possible. Only if the investor is fully aware of the distinction between the STCG and LTCG, he can reap maximum net gain out of the investment.

Long Term Capital Gains is computed as below:

LTCG = Full value of sale consideration received or accruing- (indexed cost of acquisition + indexed cost of improvement + cost of transfer)

Indexed cost of acquisition = Cost of acquisition × (CII of year of transfer/ CII of year of acquisition)

Indexed cost of improvement = Cost of improvement × (CII of year of transfer/ CII of year of improvement)

The LTCG computed as above is taken as income under the head ‘Capital Gains’ for the purposes of determining the total income.

Phrases used in the above formulas are explained below:

Full Value of Sale Consideration: The amount received or entitled to receive against the Sale of Property

Cost of Acquisition: The Expenses incurred by the assesse at the time of acquiring the Property.

Cost of Improvement: Any expense incurred by the assesse for making any alterations or additions in the property after the purchase of the same.

Cost of Transfer:Expenses incurred by the assesse for the purpose of transfer like Advertisement Expense, Brokerage Expense, Registration fees etc.

CII: Cost Inflation Index has been notified by the Central Government year wise, commencing from the financial year 1981-82.

Here is an Infographic that represents the above data:

Click here or the image for enlarged version

Hope you found this article informative. If you have any questions, feel free to ask either as a comment or use our contact form!

And if you like it, please share! We greatly appreciate that.

Formula Source: Computation of Capital Gain, Income Tax Department, Govt of India